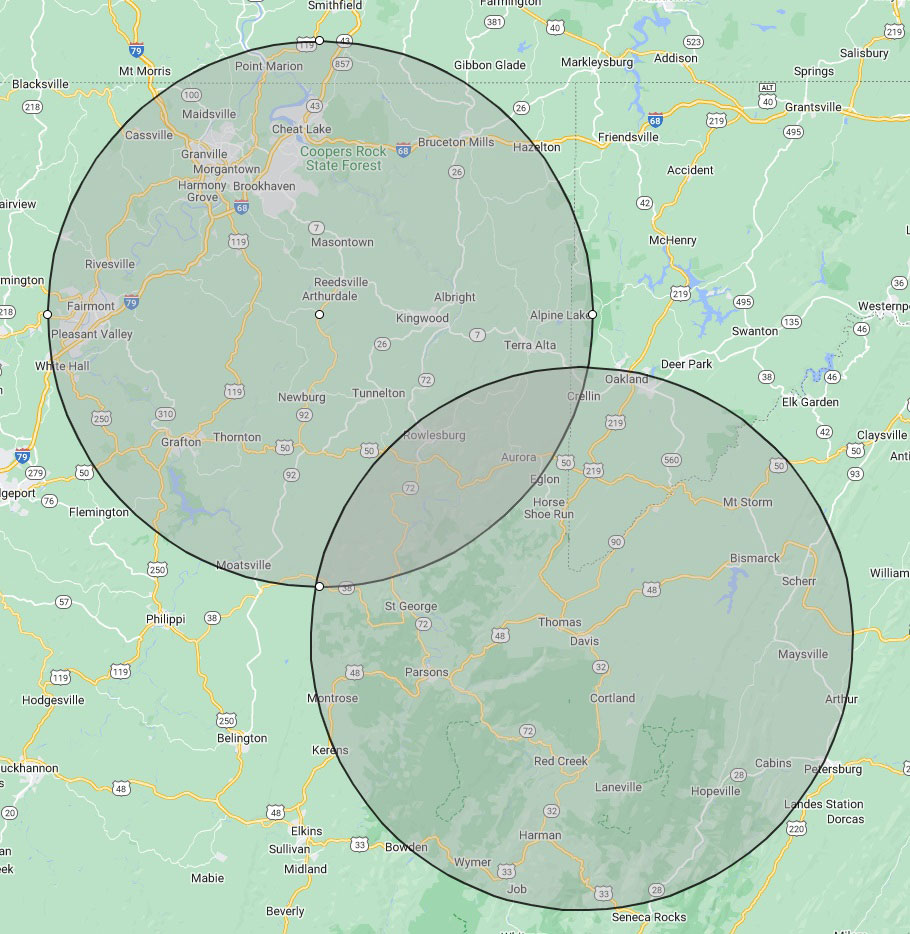

Build WV District

Developers constructing qualifying housing projects in either of Preston County’s Build WV Districts can receive State Sales and Use Tax exemptions for building materials and a 10-year property value adjustment refundable tax credit to offset building costs to encourage the construction of more workforce housing in our area.

Passed in the 2022 Legislative Session, the BUILD WV act aims to assist West Virginia’s growing communities in attracting much-needed housing development projects. The West Virginia Department of Development oversees the program and reviews all applications. All applications must be approved by James Bailey, Secretary of Commerce, Chelsea Ruby, Secretary of the Department of Tourism and Mitch Carmichael, Secretary of the Department of Economic Development.

Projects eligible for the BUILD WV Act will meet the following criteria:

- Be in a certified BUILD WV Act District

- Generate approved cost more than $3 million OR include at least six units or houses

- Create a significant positive economic impact on the State

- Directly or indirectly improve opportunity in the area where the project will be located for the successful establishment or expansion of other commercial businesses

- Provide additional employment opportunities in the State

The West Virginia Department of Economic Development oversees the program and reviews all applications. A non-refundable application fee of $5,000 is required to apply. Projects must apply and be approved prior to the completion of construction. The entire list of approval considerations can be found in Chapter 5 article 2L of West Virginia code.

“Preston County has been working to attract and develop more housing through extending infrastructure like water, sewer and broadband,” said Roberta “Robbie” Baylor, Executive Director of the Preston County Economic Development Authority. “The BUILD WV program will help attract housing construction and we expect project announcements in the near future.”